From the Telegram channel of Julian Assange

Plenty of additional Telegram channels are posting the above video, together with this comment:

The Vatican's treasure of solid gold has been estimated by the United Nations World Magazine to amount to several billion dollars. A large bulk of this is stored in gold ingots with the U.S. Federal Reserve Bank, while banks in England and Switzerland hold the rest. "But this is just a small portion of the wealth of the Vatican, which in the U.S. alone, is greater than that of the five wealthiest giant." End quote.

This was reported by Henry Mackow. There were reportedly that an international military force that repatriated 650 plane loads of gold and cash from the Vatican to the US Treasury.

A tunnel between Vatican City and Jerusalem was discovered containing gold. The amount of gold found is “more gold than you can imagine” stacked 13 levels high for the first 150 miles (241 kilometers) of the tunnel and “650 planes used to transport the gold”.

The result of this operation was the closure of over 6,000 Vatican bank accounts used for illegal activities. I do not have any conclusive info on that but there was an interesting report that came out from the Vatican itself.

In a report from http://ChristianHospitality.com they published a Congressional inquiry into the auditing of the Fort Knox gold, and they were informed by the officials responsible for that gold, that the gold in Fort Knox and other depositries in the USA (261 million ounces) is now part of the gold reserve of the International Monetary Fund (the IMF).

We have been informed by one of the top lawyers employed by the IMF (eventually sacked because she intended to whistleblow on them), that the IMF was controlled by the Vatican and the Jesuits. Who is this person you may ask? Karen Hudes. Who has exposed over the years how the IMF worked.

Of course alot has changed since she came out publicly. K. Hudes has some stand out points she has made regarding info that you all have seen on this channel. For instance.

Hudes asserts that a clandestine version of the U.S. Constitution, enacted in 1871, handed over significant control to private bankers, significantly altering the original governance framework. Which is true.

Also according to her, individuals in court are seen as debtors rather than citizens, which of course is another term if enslavement which effectively dehumanizes us and classifies us as property of the Federal Government. So on and so forth. Something none of us should be surprised to hear of course.

There's a lot to look into regarding this subject. So take your time and understand that many things have changed that will come to fruition in full force over the coming months. We are no longer under the 1871 Corp Act. Which is why the Chevron Doctrine had to be overturned.

Source: https://t.me/JulianAssangeWiki

The Vatican’s Financial Report

In a bid for transparency and reform, the Vatican bank openly published a financial report for the first time on Tuesday. But the report came amid new accounts of vague withdrawals and deposits made to and by the organization.

The Institute for the Works of Religion (IOR), the formal name for the bank, made the report available on its website as part of a series of reforms started by Pope Benedict XVI and pushed forward this year by Pope Francis.

According to the report, audited by the international firm KPMG, the bank held earnings of 86.6 million Euros for 2012, which was more than four times higher than in 2011 largely because of decreasing global interest rates.

The bank, which is privately held and does not manage the Vatican's budget, gave more than 50 million Euros of the increase over to the Vatican for its use, the report states.

While the bank and the Vatican have said the report indicates a new step along a continuing process of transparency for the financial institution, it was reported that the Vatican's own financial watchdog raised questions in 2011 about how the bank handled accounts held by foreign embassies.

The concerns by the Vatican's Financial Information Authority, according to Reuters, were over large cash deposits and withdrawals to and from the bank by the missions to the Vatican from Iran, Iraq and Indonesia.

Citing sources with knowledge of an investigation by the information authority of the matter, Reuters reported that some of the justifications for the transactions, totaling up to 500,000 Euros were vague or disproportionate to their amounts.

Also, according to Italian newspaper Corriere della Sera, the bank sent letters closing 900 accounts held by individuals or groups that didn't pass a first round of review related to transparency in the origin or movement of funds. A story published by the paper Tuesday says the bank is closing all accounts held by foreign diplomatic missions. Of the 180 nations that have diplomatic relations with the Vatican, the newspaper said at least 20 have accounts at the bank.

Pope Francis ordered a broad review of the Vatican bank's operations in June, appointing a five-member commission to ensure the bank's activities are in harmony with the mission of the universal church.

In the new report, intended to be released annually, the bank said it had about 18,900 customers at the end of 2012, with religious orders accounting for about half of its client base.

The Vatican's embassies abroad, called nunciatures, accounted for 15% of the clients; cardinals, bishops and clergy, 13%; dioceses, 9% and the rest split among employees and others.

The ability of the bank to fund religious orders around the world has long been an argument made by proponents as a key purpose.

“It is in the nature of the Catholic church that its institutions, missionary activities and charitable works reach out into parts of the world that are remote, and have very basic infrastructure, often including an underdeveloped banking and payments system,” Tuesday's report states.

“For these customers, the IOR is particularly important as a trusted, reliable and effective institution, keeping funds safe for future use or sending funds through correspondent banks to the countries in which they operate.”

The five-member commission appointed by Pope Francis to review the way the bank functions holds the status of a pontifical commission. Among its members are two Americans: Mary Ann Glendon, a former US ambassador to the Vatican, and Msgr. Peter Wells, an official at the Vatican's Secretariat of State.

Release of the 100-page annual report for the bank comes as the Vatican and the bank are entering a second round of review by Moneyval, a European agency that monitors for money laundering and financial support of terrorism. Both organizations underwent review by the agency for the first time last year and were found out of compliance in seven of 16 areas.

Since that June 2012 review, the bank and Vatican have faced scrutiny in other areas, including the handling of credit cards services and the case of a Vatican accountant accused of a plot to smuggle millions in cash into Italy.

Credit card services were shut down at the Vatican in January after the Bank of Italy refused to process payments because of concerns about inadequate money-laundering controls. Services were fully restored in May.

Two day-to-day officials of the bank resigned shortly after the former accountant, Msgr. Nunzio Scarano, was arrested for alleged involvement in a plot to smuggle 26 million Euros on behalf of a family of shipping magnates. Scarano also faces a separate criminal investigation related to suspicious movements of funds in his Vatican bank accounts.

As steps for transparency and reform at the bank continue, the pontifical commission has been granted wide authority to review its operations. The members are allowed to obtain documents and information as necessary and are allowed to interview bank personnel.

The Vatican bank, founded in its current form in 1942, traces its roots to the founding of its predecessor by Pope Leo XIII in 1887. It has 114 employees and is based inside Vatican City at the Bastion of Nicholas V.

In a note accompanying Tuesday's report, Ernst von Freyberg, the German-native president of the bank's board of superintendents, says it “has been engaged in a process of far-reaching reform” since April 2011.

“At the IOR, we are working hard on our part of the reform process: improving organization, compliance and transparency,” writes von Freyberg, who also is interim director of day-to-day operations, a post he took over in July following the resignation of the bank's director and deputy director.

Source: https://en.mercopress.com/2013/10/02/vatican-bank-opens-its-accounts-for-the-first-time-and-there-are-surprises

Is there Gold in Fort Knox?

Protected by a 109,000-acre U.S. Army post in Kentucky sits one of the Federal Reserve's most secure assets and its only gold depository: the 73-year-old Fort Knox vault. Its glittering gold bricks, totaling 147.3 million ounces (that's about $168 billion at current prices), are stacked inside massive granite walls topped with a bombproof roof. Or are they?

It’s hard to know for sure. Few people have been inside Fort Knox, a highly classified bunker ringed by fences and multiple alarms and guarded by Apache helicopter gunships. When the U.S. finished building Fort Knox in 1937, the gold was shipped in on a special nine-car train manned by machine gunners and loaded onto Army trucks protected by a U.S. Cavalry brigade. And the fort has been pretty much off limits since then. A U.S. Mint spokesman said in an email statement to MoneyWatch that the accounting firm KPMG, which audits the Mint, “has been present in the vault at Fort Knox.” The Mint won’t comment on exactly how much gold is in there, though.

That’s why Ron Paul (R-Texas), a 2008 presidential candidate known for his libertarian streak, wants to have a look around. Paul introduced a bill to audit the Federal Reserve, which includes Fort Knox’s gold. “My attitude is, let’s just find out what’s there,” he says.

Despite conspiracy theories to the contrary, no serious Fed watcher thinks Fort Knox is wholly goldless — not even Paul. The push by Paul and a conspiracy-theorist group known as Gold Anti-Trust Action Committee (GATA) to open Fort Knox’s 22-ton door is more about their loathing of the Federal Reserve and its purported growing powers. “The gold market is being manipulated by the Fed,” says GATA spokesman Chris Powell. “It’s involved in gold swap agreements with foreign banks. Gold is a major determinant of interest rates.”

How Important Is Fort Knox?

The bad news for Goldfinger buffs, say gold analysts, is that Fort Knox doesn’t really matter much anymore.

Fort Knox began losing its luster when the United States went off the gold standard in 1971. Before that, gold bars packed into a secure vault gave people faith in the country’s currency. Today, however, Fort Knox’s gold is now an asset on the Federal Reserve’s balance sheet, not a key part of our monetary system.

Though Fort Knox’s security overkill may seem a quaint relic of bygone days — like the Beefeaters guarding the Tower of London — the gold there and at U.S. Mint facilities adds up to one of the world’s largest bullion holdings. Still, it’s a tiny part of the nation’s total assets. In a $13.8 trillion GDP economy, 147.3 million troy ounces of gold barely registers.

“It may lend some confidence to investors that we have large gold reserves,” says Mark Zandi, chief economist at Moody’s Economy.com. “But it’s more symbolic than substantive.”

The Fed’s gold is valued at a tremendously low figure — just $42.22 an ounce. The rock-bottom figure was set in 1973, two years after we left the gold standard, primarily to avoid wild accounting swings. “What would happen if the price of gold drops dramatically?” asks Dimitri Papadimitriou, president of the Levy Economics Institute at Bard College. “The Fed balance sheet would be dramatically lower.”

Time for Fort Knox to Sell?

The Fed won’t be unloading large stashes from Fort Knox anytime soon. Doing so would flood the market and send the price of gold spiraling downward. “A small, vocal group of gold bugs would be against it,” says John Irons, research and policy director at the Economic Policy Institute, a liberal think tank. “The Fed wouldn’t want to stir things up.”

But Irons and some other economists would like to see the U.S.’s gold reserves thinned out. “The Fed could sell a lot of the gold,” says Irons. “It’s better used in jewelry or in electronics. It can be useful to the private economy rather than buried in a vault.” The sale could make a small dent in the $12.1 trillion national debt and, with the price of gold near its all-time high, this is a particularly good time to sell.

The reason Fort Knox will remain a mighty fortress, however, may come down to something Alan Greenspan once told Paul. When Paul asked the former Fed Chairman why the Fed hangs onto its hefty gold reserves, “Greenspan said ‘just in case we need it,’” says Paul.

“You hold onto it because it’s the ultimate in money.”

Source: https://www.cbsnews.com/news/is-there-gold-in-fort-knox/

The Value of Gold

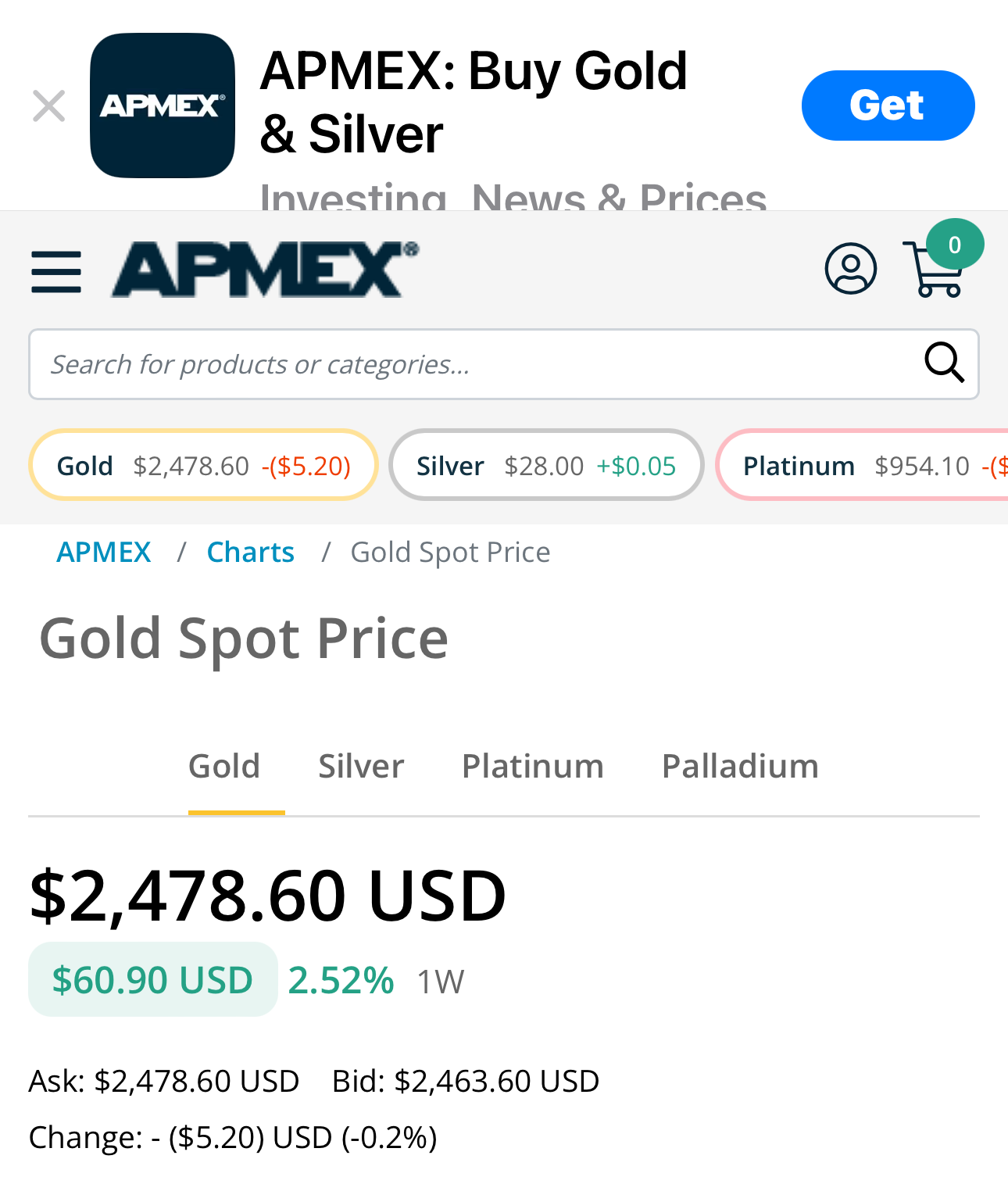

This is from today:

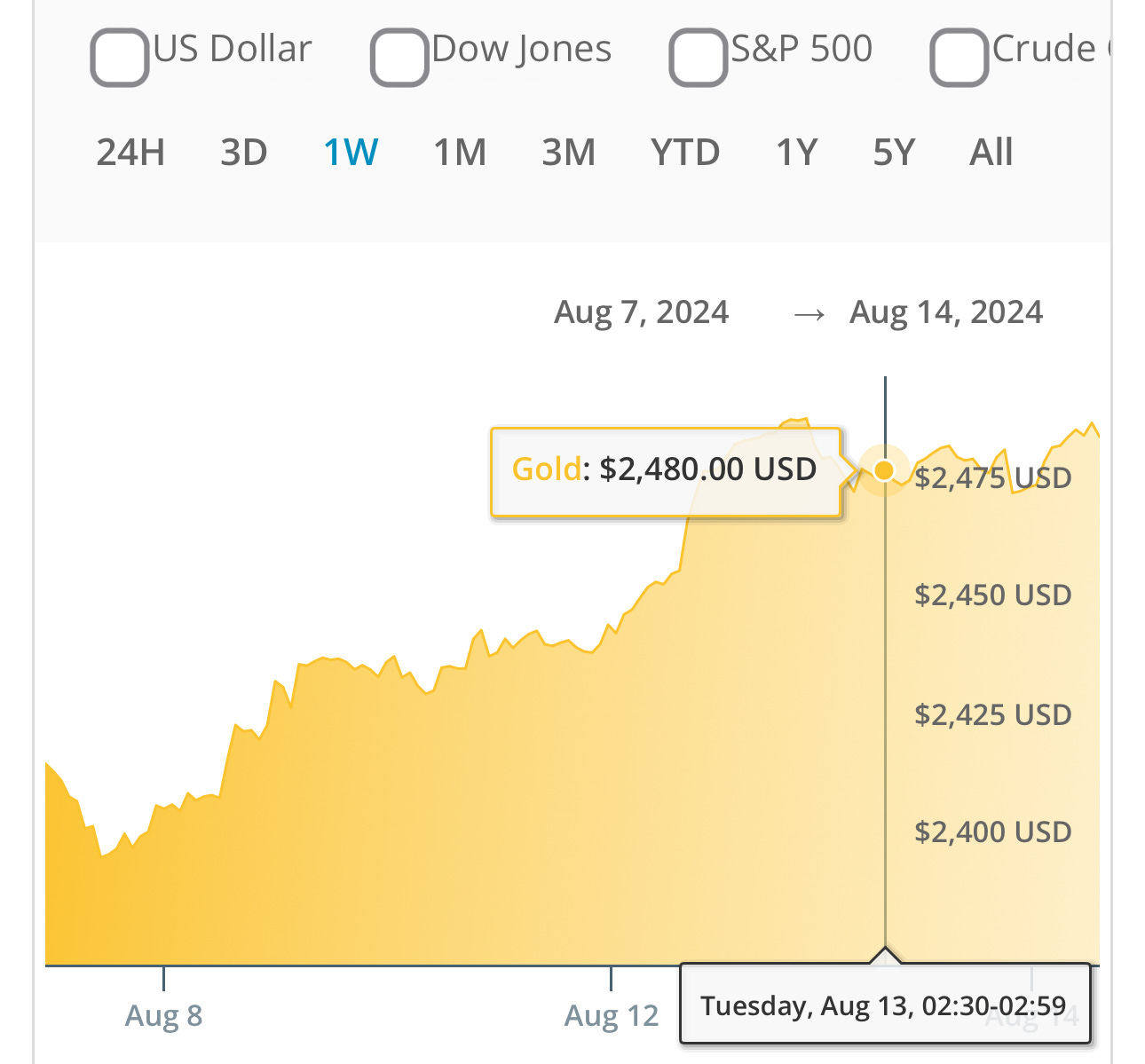

This is the trend:

A couple days ago, gold hit the highest

I have heard it said that in the 1800’s, single gold coin bought a man's suit, shoes, and belt.

Today, it buys the same thing.

I was wondering if you could cast bullets from gold? I know you can eat gold but I don't think it is very nutritious...? Just thinking about after the apocalypse.

Very interesting. Can anyone make sense of this line? "A tunnel between Vatican City and Jerusalem was discovered containing gold." I'm no ace with geography, but it seems to me this must have another meaning.